Discover how Jio Health Insurance is disrupting the industry of health insurance. Learn five facts about how this innovative provider is working to bring down the cost of healthcare for the population at large.

Introduction

Currently, this option is not mandatory for everyone but is a necessity for a large number of people. To avoid having to borrow money for medical bills in this stage where the cost of health has reached its roof, one ought to have reasonable health insurance coverage. Among the potential competitors that are in operation in this field, one of the contenders is Jio Health Insurance. In this guide, am going to highlight all that you need to know about Jio Health Insurance ranging from the benefit of the program, the way to go about coverage it and much more.

What is Jio Health Insurance?

Jio Health Insurers is one of the service providers in India under the Jio brand, disrupting many industries including telecommunication and digital services in India. Initiated with the purpose of affordable and convenient health insurance solutions for everyone. Jio Health Insurance looks to offer protection solutions for you and your families.

Background of Jio Health Insurance

Jio’s Health is a new company established by Reliance Industries and has already gained much interest within the health sector. Using high-end information technology and comprehensive market analysis Jio Health Insurance presents insurance products that meet the market’s requirements.

Launch and Vision-Mukesh Amban

Reliance Jio Financial Division, Jio’s Financial Services, Insurance Plans, Including Life, General and Health Insurance for Its Customers, Announced Reliance Industries’ Chairman and Managing Director Mukesh Ambani During 46Th Annual General Meeting.

The Company intends to venture into the sector by partnering with international Players. Jio Financial Services Co-create, Product and Delivery Based on Unique Customer Requirements Using Predictive Data Analytics.

Basic Features of Jio Health Insurance

Comprehensive Coverage

Jio’s Health Insurance can offer various plans for an individual such as Inpatient Hospitalization, Pre and Post Hospitalization expenses, Day Care Procedures, etc. This means that there is almost any kind of medical condition that you are assured of being taken care for.

Affordable Premiums

As for Jio’s Health Insurance’s strengths, the product is considered truly affordable. The plans are affordable so that all individuals can be able to make their subscriptions without limiting the quality of the coverage.

Cashless Hospitalization

By enrolling with Jio’s Health Insurance, you can achieve a cashless facility in several Tie-up network hospitals, which makes the claim process smooth and efficient.

No Claim Bonus

One feature they enjoy includes obtaining a no-claim bonus for every year they do not make a claim and receiving more coverage without having to pay for it.

Types of Jio Health Insurance Plans

Individual Health Plans

These plans are for those people who are in search of an affordable health plan. They include a huge of all medical costs and dedicate some advantages.

Family Floater Plans

Family floater plans insure the whole family under one premium and hence are the easiest option to opt for when it comes to health insurance among family members.

Critical Illness Plans

Critical Illness Plans aim to bring for illnesses such as cancer, and heart attack among others. It allows the policyholders to receive the necessary financial assistance in case of severe

health complications.

Senior Citizen Plans

These plans are specially designed for individuals of senior age and include a large number of medical conditions related to age and enough to cover these patients.

Benefits of Jio Health Insurance

Financial Security

About health insurance Health insurance offers financial protection against sickness or any other health challenges that may occur at an extra cost.

Wide Network of Hospitals

Jio’s Health Insurance also has a congested network of empanelled hospitals, so that you can avail the best of healthcare, no matter where you are.

Easy Claim Process

The claim process with Jio’s Health Insurance is simple and uncomplicated so that the policyholders along with their loved ones can concentrate on the recovery process rather than the formalities of lodging claims.

Preventive Health Check-ups

It is also necessary to get routine check-ups so that any complications that may be developing can be addressed early enough. Jio Health Insurance incorporated preventive health check-ups as well in their plans.

How to Apply for Jio Health Insurance

Online Application Process

You can easily apply for Jio’s Health Insurance and the process is completed online. Go to the official site, select your package, and enter the required information.

Required Documentation

You are going to need some of the essential documents such as identity proof, address proof, and health history (if necessary) for filling out the application form.

• Steps for Enrollments.

• Visit the official Jio’s Health website.

• Select the plan that suits your needs.

• Fill in the required personal and medical details.

• Submit the necessary documents.

• Make the payment online.

• Receive the policy document via email.

• Understanding the Premiums

• Factors Affecting Premiums

• Several factors influence the premium amount, including age, medical history, lifestyle habits, and the type of plan selected.

How to Calculate Premiums

Use the online premium calculator available on the Jio’s Health Insurance website to get an estimate of your premium based on the provided information.

• Go to the official Website

• Provided Details filled online.

• Choose a Plan and Add on service

• Opt for higher deductibles or Tenure.

• Maintain a healthy lifestyle.

• Choose a plan with essential coverage only.

Claim Process of Jio Health Insurance

How to File a Claim?

To file a claim, you need to inform the insurance company as soon as possible and submit the required documents.

Provide Documents for Claims

Commonly required documents include the claim form, hospital bills, medical reports, and discharge summary.

Timeline for Claim Settlement

Jio’s Health Insurance aims to settle claims within 7 days, ensuring quick reimbursement or cashless service.

Exclusions and Limitations

Pre-existing Conditions

There is usually a waiting period for pre-existing conditions before they are covered under the policy.

Waiting Periods

Certain treatments and conditions may have a waiting period before the coverage kicks in.

Other Exclusions

• Cosmetic treatments

• Self-inflicted injuries

• Experimental treatments

• Comparing Jio Health Insurance with Other Providers

Advantages Over Competitors

Jio’s Health Insurance offers competitive premiums, extensive coverage, and a wide network of hospitals, making it a strong contender in the health insurance market.

Areas for Improvement

While Jio’s Health Insurance is robust, it can improve by expanding its coverage options and reducing waiting periods.

Customer Reviews and Testimonials

Positive Feedback

Many customers praise Jio’s Health Insurance for its affordable premiums and easy claim process.

Common Concerns

Some users have reported issues with network hospital availability in certain areas.

Tips for Choosing the Right Health Insurance Plan

Assessing Your Needs

Consider your health needs, family size, and budget when selecting a health insurance plan.

Comparing Plans

Compare different plans based on coverage, premiums, and benefits before making a decision.

Consulting with Experts

Seek advice from insurance experts to ensure you choose the best plan for your needs.

Future of Jio Health Insurance

Upcoming Features

Jio’s Health Insurance is continuously evolving, with plans to introduce more innovative features and benefits.

Market Trends

The health insurance market is growing, and Jio’s Health Insurance is poised to be a significant player in this space.

Common Myths About Health Insurance

Expose Myths

Many believe health insurance is unnecessary if they are healthy. However, health crises are unpredictable, making insurance essential.

Facts About Health Insurance

Health insurance provides financial security and access to quality healthcare, which is crucial in today’s world.

Our Recommended and Suggestion of Jio Health Insurance

It’s under plan Jio’s health insurance is not provided currently and no health insurance is provided for free if you have any Jio/’s health insurance link get it and ignore

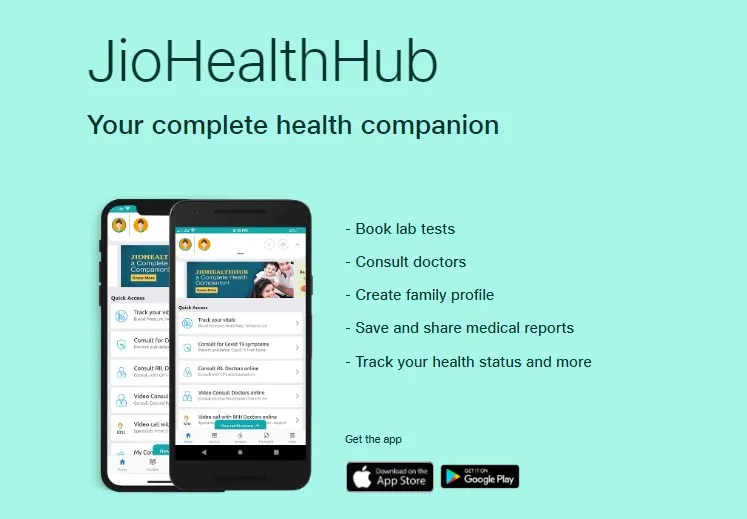

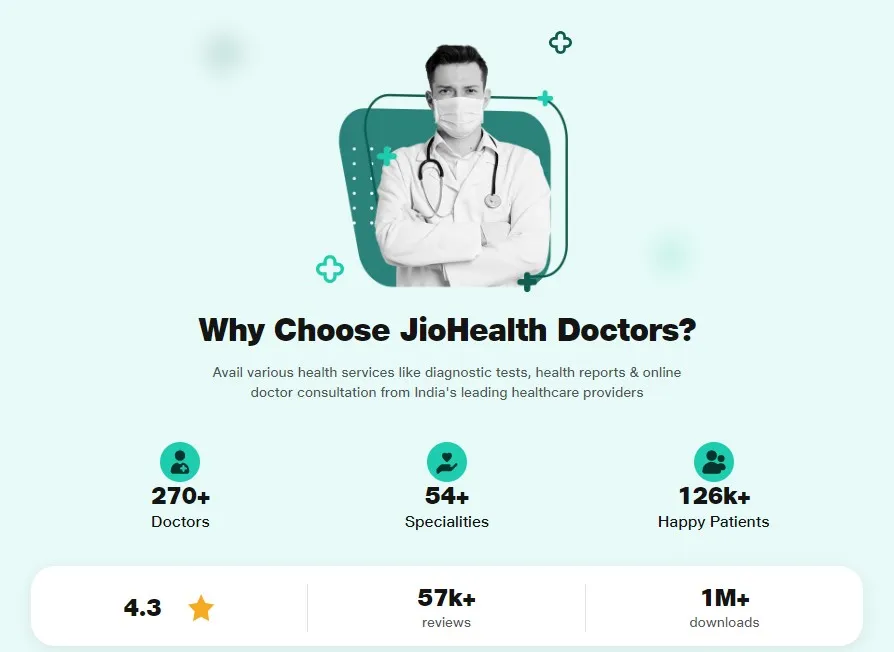

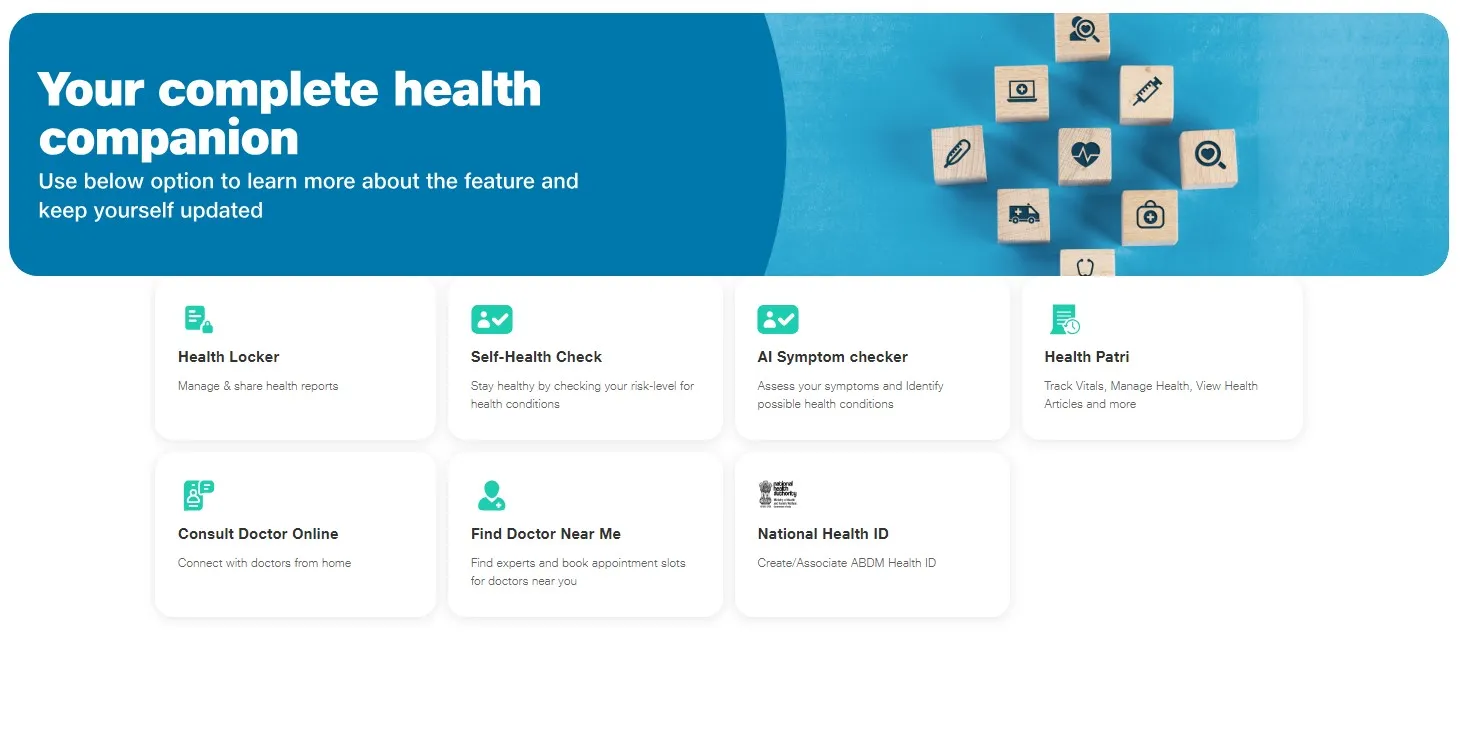

However, Jio Heath Hub Provide an Affordable Health Plan for you.

Here is the Plan list that is currently available on Jio’sHealth Hub website

Click here to View the Online Health Jio Plan on the official website.

- Health Locker

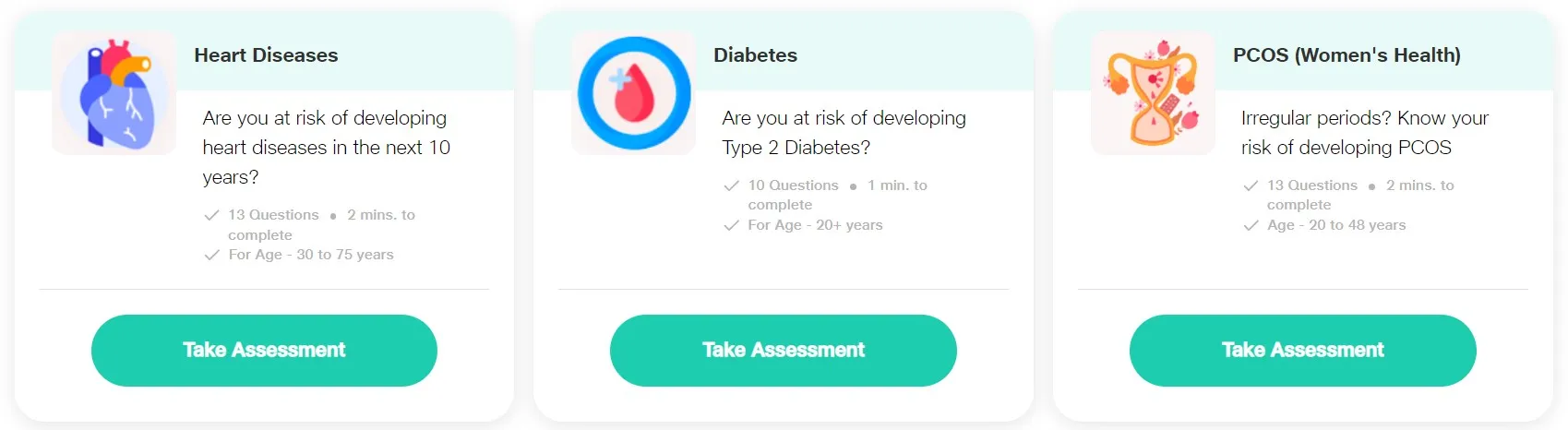

- Self-Health Check

- AI Symptom Checker

- Health Patri

- Consultant Doctor Online

- Find a Doctor Near me

- National Health Card

Conclusion

Jio’s Health Insurance offers a comprehensive, affordable, and reliable health insurance option for individuals and families. With extensive coverage, easy claim processes, and a focus on customer satisfaction, Jio’s Health Insurance is a strong choice for anyone looking to secure their health and financial future.

FAQ- JIO HEALTH INSURANCE

What is the minimum age to apply for Jio’s Health Insurance?

The minimum age to apply for Jio Health Insurance is 18

Can I switch my current health insurance to Jio’s Health Insurance?

Yes, you can port your existing health insurance policy to Jio’s Health Insurance, subject to certain terms and conditions.

Does Jio Health Insurance cover COVID-19?

Yes, Jio Health Insurance provides coverage for COVID-19 treatment as per the terms of the policy.

How can I check the status of my claim?

You can check the status of your claim online through the Jio Health Insurance website or by contacting their customer support.

MUST READ WHY HEALTH INSURANCE REQUIRED FOR EVERYONE