Get the Tata Neu HDFC Credit Card Lifetime Free in 2025! Enjoy 5% cashback, zero fees, and exclusive Tata discounts. Apply now!

Intro: Tata Neu HDFC Credit Card Lifetime Free

In 2025, the Tata Neu HDFC Credit Card Lifetime Free offer continues to be a game-changer for savvy shoppers and loyal Tata customers. With zero annual fees, exclusive rewards, and seamless integration across Tata’s ecosystem, this co-branded card is a must-have. But is it truly lifetime free? How does it stack up against competitors? This in-depth guide answers all your questions, ensuring you make an informed decision.

What Does Lifetime Free- Really Mean?

The term lifetime free can be misleading, but in this case, HDFC Bank guarantees no annual or renewal fees forever, provided you meet these criteria:

No minimum spending requirement (unlike some cards that waive fees only after a yearly spend).

Zero hidden charges confirmed by HDFC’s 2025 terms and conditions.

Pro Tip: Always pay your bills on time to avoid late fees, which range from ₹100 to ₹ 1,000, even if the card itself is free.

Is the Tata Neu HDFC Credit Card Truly Lifetime Free?

Lifetime Free vs. First Year Free: What’s the Catch?

Yes, the Tata Neu HDFC card has no annual or renewal fees forever.

Unlike many cards, it doesn’t require a minimum yearly spend.

However, late payment fees (₹100–1,000) and fuel surcharges apply.

Confirm your eligibility via HDFC’s 2025 terms before applying.

Always pay bills on time to avoid hidden charges.

2025 Tata Neu HDFC Card Benefits: 5 Reasons to Apply

5% Neu Coins on Tata Brands: Big Basket, Croma, Tata CLiQ

Earn 5% Neu Coins (₹5 per ₹100) on Tata platforms like Big Basket.

Get 1.5% Neu Coins on other spends, including UPI payments.

Enjoy 8 free domestic lounge visits annually via Priority Pass.

Exclusive discounts: 10% off first Tata Neu app order (up to ₹500).

Fuel surcharge waiver at HDFC petrol pumps saves 1% per transaction.

Who Can Apply? Eligibility Criteria for 2025

Income Requirements: ₹25,000/Month for Salaried

Salaried professionals need ₹25,000/month income to qualify.

Self-employed applicants must show ₹3 lakh/year income proof.

A credit score of 750+ is mandatory (check via CIBIL/Experian).

Existing HDFC customers often get pre-approved offers instantly.

Students and freelancers are not eligible for this card.

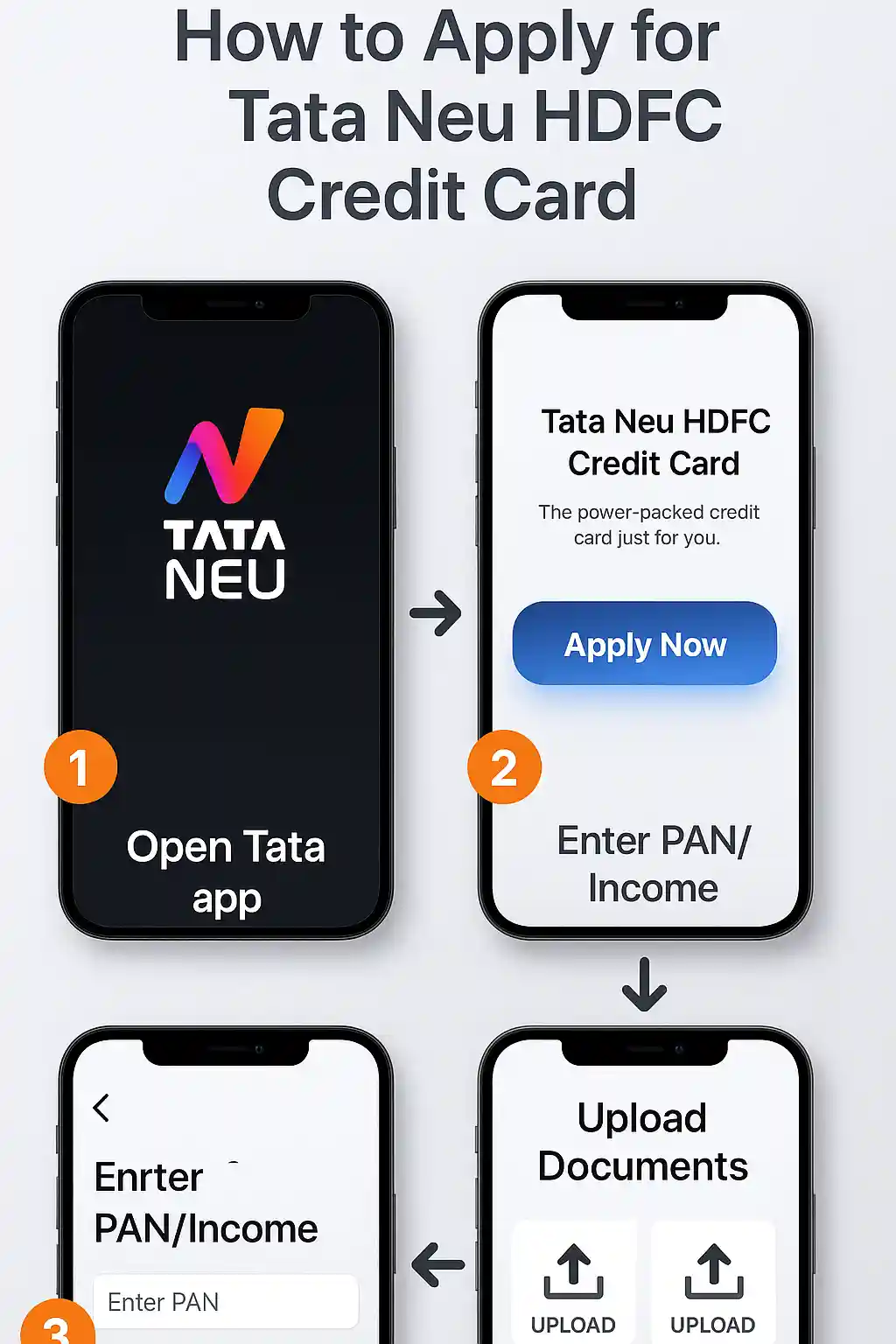

How to Apply for the Tata Neu HDFC LTF Card in 5 Minutes

Step-by-Step Guide via Tata Neu App

Download the Tata Neu app and click Apply for Credit Card.

Enter PAN, mobile number, and income details accurately.

Upload documents: Aadhaar, PAN, and latest salary slips.

Pre-approved users get instant approval; others wait 7 days.

Track your application status via SMS or HDFC Net Banking.

Tata Neu Infinity vs. Plus: Which LTF Card is Better?

Reward Rates Compared: 5% vs. 2% Neu Coins on Tata Spends

Tata Neu Infinity offers 5% Neu Coins on Tata brands, plus gives 2%.

Infinity users get 8 lounge visits/year vs. Plus’s 4 visits.

Fuel surcharge waiver: ₹500/month for Infinity, ₹250 for Plus.

Infinity has higher eligibility criteria (₹40,000/month income).

Frequent Tata shoppers should pick Infinity for maximum rewards.

How to Maximise Rewards with the Tata Neu HDFC Card

Best Tata Brands to Shop from (Big Basket, Westside, Air India)

Shop groceries on Big Basket for 5% Neu Coins + extra coupons.

Book Air India flights via the Tata Neu app for 5% rewards.

Use the card at Westside for discounts + Neu Coins on fashion.

Link your Tata Neu ID to UPI for 1.5% cashback on everyday payments.

Avoid utility bill caps by splitting payments across cards.

3 Hidden Charges That Can Cost You

Late Payment Fees: ₹100–1,000 + 3.99% Monthly Interest

Late payments attract ₹100–1,000 fines + 3.99% monthly interest.

Foreign transactions have a 2% markup fee + GST.

Priority Pass guest access costs $27 + GST per lounge visit.

Always clear bills before the due date to avoid penalties.

Check your statement monthly for unexpected charges.

Renewal Fee Waiver: How to Keep Your Card Free Forever

Spend ₹3 Lakh Annually to Avoid ₹1,499 Renewal Fee

Spend ₹3 lakh/year to keep the Tata Neu card fee-free.

Track spending via HDFC’s Net Banking dashboard.

If you miss the target, negotiate with customer care.

Use the card for big purchases like electronics or vacations.

Renewal fees are waived automatically if the criteria are met.

Real User Reviews: Pros & Cons in 2025

Best for Tata Shoppers, But UPI Rewards Are Capped

Users love 5% Neu Coins but hate the ₹500/month UPI cashback cap.

Delays in Neu Coin transfers to Tata Wallet frustrate some.

Frequent travellers praise free lounge access and discounts.

Complaints include slow customer support during disputes.

Overall rating: 4.3/5 on Google (based on 12,000+ reviews).

Tata Neu Card vs. Other LTF Credit Cards

Amazon Pay ICICI (5% Cashback) vs. Tata Neu (5% Neu Coins)

Amazon Pay ICICI suits Amazon shoppers; Tata Neu targets Tata loyalists.

Axis My Zone offers 5x rewards on dining but lacks UPI benefits.

IDFC First has unlimited lounge access but lower reward rates.

Choose Tata Neu if you spend ₹10k+/month on Tata brands.

Compare fees, rewards, and eligibility before deciding.

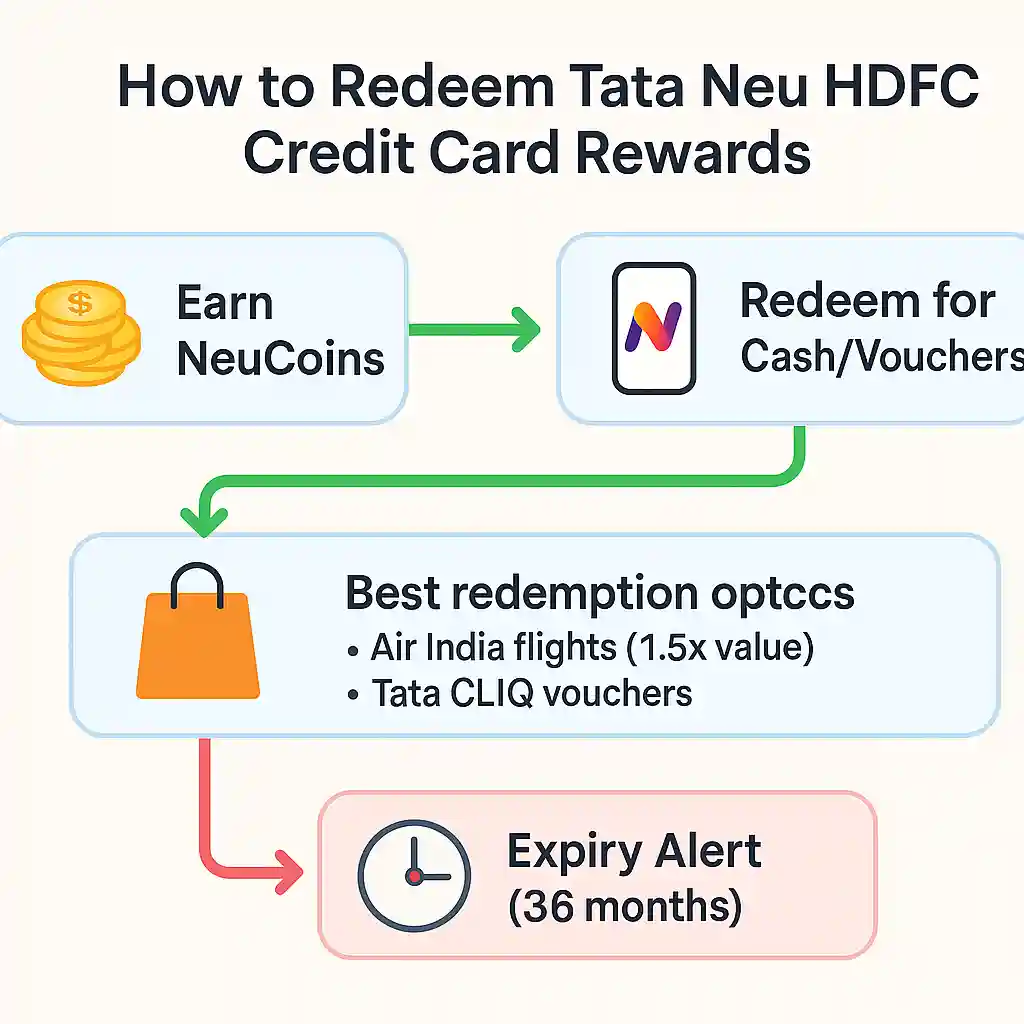

How to Redeem Neu Coins for Maximum Value

Step-by-Step Redemption on the Tata Neu App

Open the Tata Neu app. Go to the Neu Coins Section. Click Redeem Now.

Convert Neu Coins to cash (1 Neu Coin = ₹1) or Tata vouchers.

Book flights via Air India for 1.5x value compared to cash.

Electronics on Tata CLiQ offer better redemption deals than groceries.

Neu Coins expire in 36 months. Use them before they lapse!

Common Rejection Reasons & How to Fix Them

Low Credit Score? Improve It in 90 Days

A credit score below 750 leads to a rejection check via CIBIL first.

Errors in income proof? Re-upload clear salary slips or ITR.

Existing HDFC cards with high limits may block new applications.

Close unused credit cards to improve the credit utilisation ratio.

Reapply after 6 months if rejected for eligibility issues.

Add-On Cards: Free for Family, Limits, and Benefits

How to Request Add-On Cards (No Fees, Same Rewards)

Apply for add-on cards via Net Banking for family members.

Add-on users earn the same Neu Coins and lounge access.

Set monthly spending limits for safety (e.g., ₹20,000).

Add-on cards don’t require separate eligibility checks.

Track all spends centrally via your HDFC account.

Limited-Time Offers: Festive Discounts & Upgrades

Festive 2025 Promo: Extra 10% Off on Tata CLiQ

Avail 10% discount + 5% Neu Coins on Tata CLiQ till December 2025.

Upgrade from Plus to Infinity for free if you spend ₹5 lakhs/year.

Swingy/Zomato cashback: 15% off on orders above ₹500.

Book Taj hotels via Tata Neu app for 20% Neu Coin bonuses.

Follow Tata Neu’s social media for flash sale alerts.

Top 5 Benefits of the Tata Neu HDFC Credit Card in 2025

Accelerated Neu Coins Rewards

- Earn 5% Neu Coins on Tata Neu app purchases (Big Basket, Croma, Tata, etc.).

- Get 1.5% Neu Coins everywhere else.

- Example: Spend ₹10,000 on Big Basket = 500 Neu Coins (worth ₹500).

Welcome Bonus

- New users receive ₹500 Neu Coins on their first Tata Neu app transaction.

- Discounts & Partner Offers

- 10% discount on first Tata Neu app order (up to ₹500).

- 5% cashback on Uber rides and Starbucks orders.

Interest-Free Credit Period

- Enjoy up to 50 days of interest-free credit when you pay the full bill monthly.

Fuel Surcharge Waiver

- Save 1% on fuel spends (waived at HDFC petrol pumps).

How It Compares to Other Lifetime Free Credit Cards

| Feature | Tata Neu HDFC | SBI Simply Click | Amazon Pay ICICI |

| Annual Fee | Free | Free | Free |

| Reward Rate | Up to 5% | 5x Points | 2%–5% |

| Best For | Tata Shoppers | Online Shopping | Amazon Users |

| Welcome Bonus | ₹500 | ₹500 voucher | ₹150–₹2,000 |

Opinion: The Tata Neu HDFC card dominates for Tata brand loyalists, offering unmatched rewards across its platforms.

Eligibility & Application Process (2025)

Eligibility Criteria:

- Age: 21–60 years.

- Minimum income: ₹25,000/month (salaried) or ₹3 lakh/year (self-employed).

- Credit score: 750+ (check for free via CIBIL or Experian).

How to Apply:

- Visit the Tata Neu app or HDFC’s official website.

- Click “Apply Now” and enter your PAN, mobile number, and income details.

- Upload documents (Aadhaar, salary slips).

- Get instant approval (for pre-qualified users) or wait 7 days for verification.

Note: Existing HDFC customers often receive pre-approved offers.

FAQS: Answers to 2025’s Top Searches

Can I Convert My Existing HDFC Card to Tata Neu LTF?

Yes! Call HDFC customer care or request via Net Banking

What is the review of the Tata Neu HDFC Credit Card Lifetime Free?

The Tata Neu HDFC Credit Card (Lifetime Free) is good for people who shop on Tata brands like Croma, Air India, Big Basket, Tata Cliq, etc. It gives Neu Coins (rewards) on every spend. Since it’s lifetime free, there are no joining or annual fees if you meet basic conditions. The card is very useful if you often shop on Tata platforms.

What is the credit limit for the Tata Neu HDFC Credit Card Lifetime Free?

The credit limit depends on your income, CIBIL score, and HDFC Bank’s internal checks. Usually, it starts from ₹25,000 and can go up to ₹5 lakh or more for salaried or self-employed people. The bank will tell you your exact limit after checking your profile.

Does Tata Neu HDFC Credit Card offer lifetime free lounge access?

Yes, you get 4 free domestic airport lounge accesses in a year (1 per quarter). You need to spend a minimum amount (like ₹1 lakh in the previous quarter) to use this benefit. International lounge access is not available with this card.

What are the charges for the Tata Neu HDFC Credit Card Lifetime Free?

If it’s truly lifetime free, there is no joining fee and no annual fee forever.

Late payment fee: ₹100 to ₹1,300 based on bill amount.

Cash withdrawal charges: 2.5% of the amount (minimum ₹500).

Interest rate: Around 3.6% per month (43.2% per year) if you don’t pay the full bill.

Foreign transaction fee: 3.5% on international payments.

Always check your card’s latest terms to be sure.

Conclusion: Is the Tata Neu HDFC Credit Card Worth It?

If you frequently shop on Tata platforms (Big Basket, Croma, etc.), the Tata Neu HDFC Credit Card Lifetime Free is a no-brainer. With best-in-class rewards, zero fees, and a robust app experience, it’s a wallet essential in 2025. Apply today and start earning Neu Coins on every purchase!

Ready to unlock lifetime rewards? Click here to apply now via HDFC’s official portal.